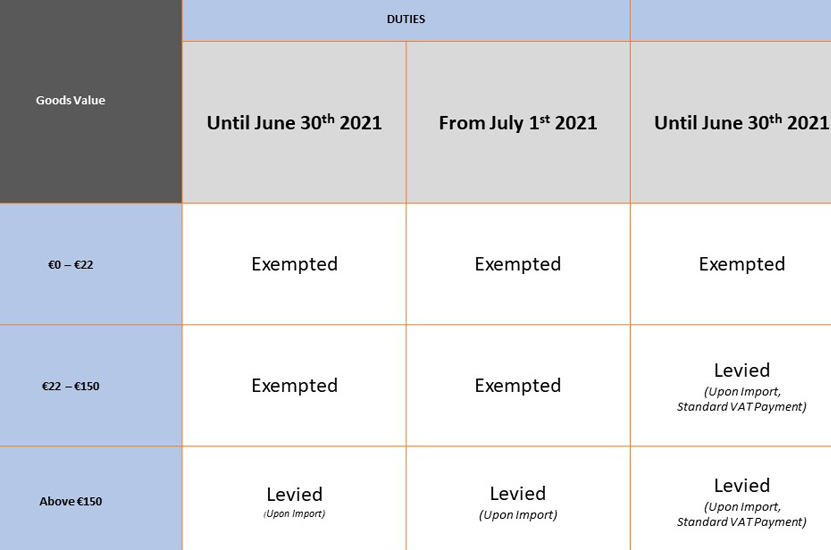

On 1st July 2021, changes to the way goods will be charged Taxes and Duties will come into effect for organisations selling imported goods to buyers in the EU. The import One-Stop Shop (IOSS) was created by the EU Commission to facilitate and simplify the payment of VAT for distance sales of imported goods with a value not exceeding €150.

Here are the facts:

Overview

- For sellers registered with the scheme, IOSS makes the process easier for the buyer, who is charged VAT at the time of purchase.

- From July 1st 2021, ALL goods imported to the EU will be subject to VAT, i.e. the current VAT exemption for importation of goods up to €22 will be removed. The VAT rate is the one applicable in the EU Member State where the goods are to be delivered.

- Currently, low value shipments below €22 may be cleared with a Manifest Clearance, where multiple low value shipments are grouped under one declaration. With the EU decision to abolish the VAT relief as of 1st of July 2021, all shipments imported to the European Union (EU) will require a FORMAL Customs Declaration (1 per shipment).

- This new process is for goods up to €150. Definition of goods value: is intrinsic value (the price at which the goods are sold, excluding transport and insurance costs, unless they are included in the price and not separately indicated on the invoice). It is important to note that the threshold applies to the value of the consignment, not to each individual item.Goods over €150 will be taxed at importation in the EU Member State as per standard/existing procedure (this also applies where the overseas seller has sold several goods to the same buyer and these goods are shipped in a package amounting to more than €150).

- Different VAT collection possibilities available for B2C Shipments up to €150 are still available when not IOSS registered.

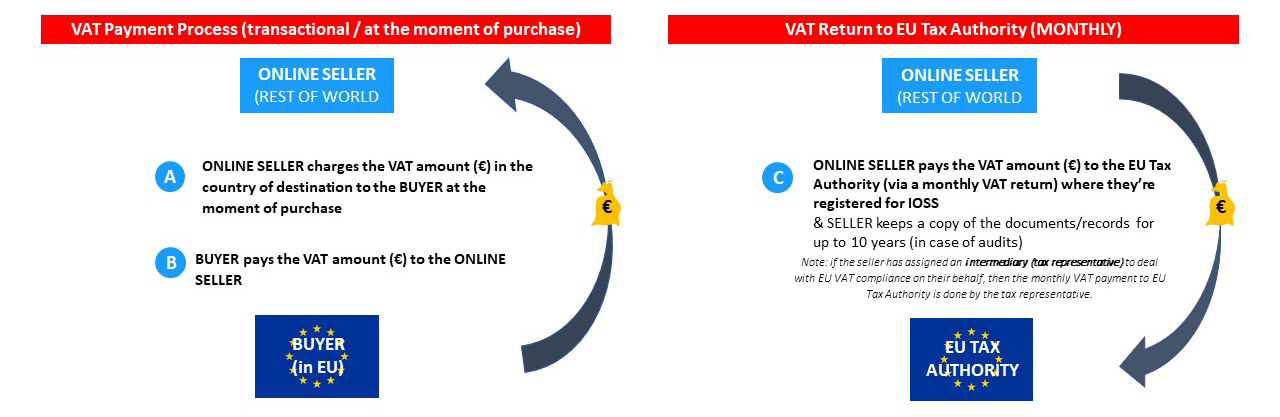

VAT Payment

One-Time IOSS Registration

- In order to use the IOSS, the online seller (non-EU but with EU representation) must register for IOSS in one European Union country. Please note there are restrictions around registration.

- Upon registration, the seller will be given one unique IOSS number which is valid for ANY country in the European Union.

- The online seller can assign an intermediary (tax representative) to deal with EU VAT compliance on their behalf, i.e. to pay the VAT amount to the EU Tax Authority (via a monthly VAT return).

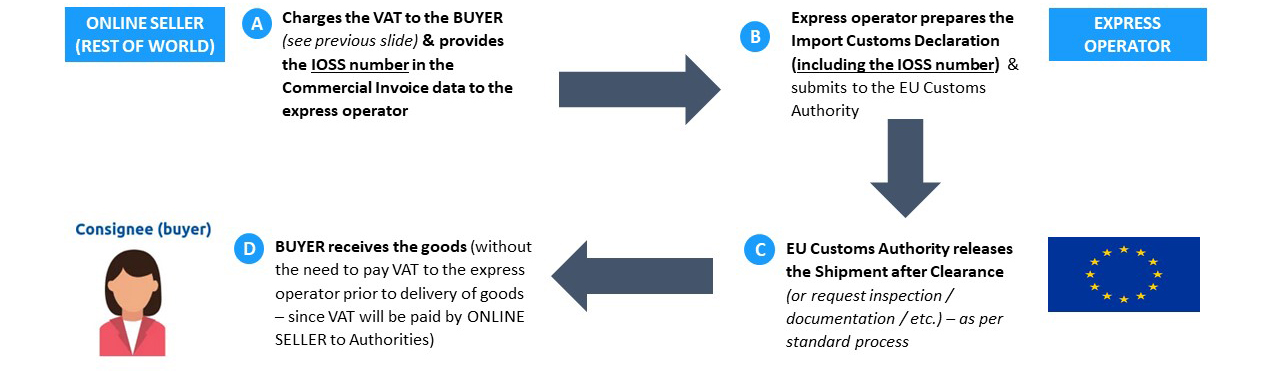

Customs Clearance

- If the VAT has already been charged (see previous slide), then the seller must indicate the IOSS number in the Commercial Invoice data to the express operator.

- The express operator will then include the IOSS number in the Import Customs Declaration submission to the EU Customs Authorities – below an overview:

Different VAT collection possibilities available for B2C shipments up to EUR 150

With IOSS (for B2C only)

- Introduces an IOSS (Import One-Stop Shop) VAT collection model with the VAT to be collected by the seller at the moment of purchase for B2C shipments.

- Companies can assign an intermediary (tax representative) to deal with EU VAT compliance on their behalf, i.e. to pay the VAT amount to the EU Tax Authority (via a monthly VAT return).

- Key Advantage: ONE Single EU VAT Registration (covering all the 27 EU countries), different than current setup, which requires 1 VAT registration for each EU country in case of DDP.

Without IOSS (for B2C or B2B)

- Same as current process in place for shipments above €22 (where either the express operator pays VAT to Authorities upon import and then charges the shipper, or the shipper pays VAT directly to Authorities with its own deferment account).

Information provided by Flight Logistics Group Ltd is in the context of guidance only, the content of this presentation therefore does not, in any way, constitute legal advice. Should you require a legal opinion, you must obtain that opinion from a properly qualified professional.