EXPORTS

Export Guidance

Important News: Northern Ireland

Implementation of the Windsor Framework has now been deferred by the Government until March 31st 2025. Companies should continue to prepare as the registration process is lengthy.

EU Destinations

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Rep, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

Requirements for supplier declarations from 1 January 2022

If you make out statements on origin for goods you export to the EU, you must have supplier declarations (where needed) at the time you export your goods.

If you’re asked to verify the origin of your goods and you can’t provide this supporting

evidence:

- your EU customer will be liable to pay the full (non-preferential) rate of Customs Duty,

- you may be charged a penalty, and

- you may be excluded from using preferential tariffs going forward.

Statement On Origin

One option for claiming preference is for the importer to use a ‘statement on origin’ made out by the exporter. A statement on origin is prescribed text which the exporter adds to the invoice or any other document, including a commercial document, that describes the originating product in enough detail to allow it to be identified. The statement or document may be in an electronic format.

For more information follow this link to the HMRC Guidance

Import One Stop Shop Scheme (IOSS) factsheet

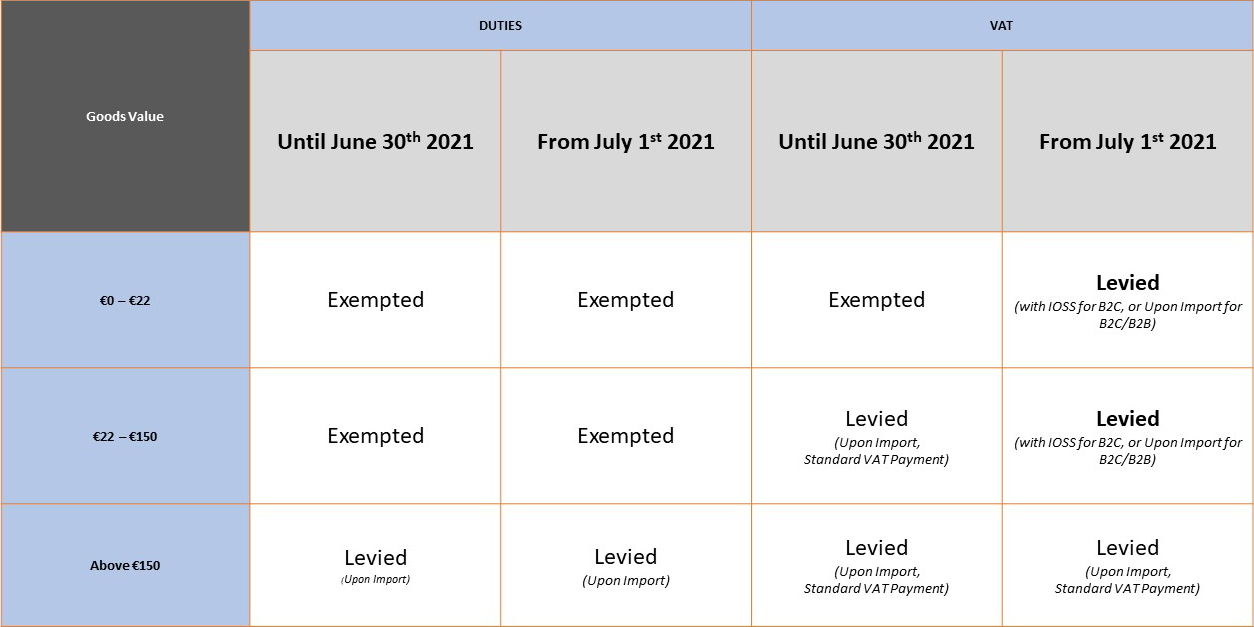

On 1st July 2021, changes were made to the way Taxes and Duties are charged for organisations selling imported goods to buyers in the EU. The import One-Stop Shop (IOSS) was created by the EU Commission to facilitate and simplify the payment of VAT for distance sales of imported goods with a value not exceeding €150.

Here are the facts:

Overview

- For sellers registered with the scheme, IOSS makes the process easier for the buyer, who is charged VAT at the time of purchase.

- ALL goods imported to the EU are subject to VAT. The VAT rate is the one applicable in the EU Member State where the goods are to be delivered.

- With the EU decision to abolish the VAT relief as of 1st of July 2021, all shipments imported to the European Union (EU) requires a FORMAL Customs Declaration (1 per shipment).

- This process is for goods up to €150. Definition of goods value: is intrinsic value (the price at which the goods are sold, excluding transport and insurance costs, unless they are included in the price and not separately indicated on the invoice). It is important to note that the threshold applies to the value of the consignment, not to each individual item. Goods over €150 will be taxed at importation in the EU Member State as per standard/existing procedure (this also applies where the overseas seller has sold several goods to the same buyer and these goods are shipped in a package amounting to more than €150).

- Different VAT collection possibilities available for B2C Shipments up to €150 are still available when not IOSS registered.

Import One-Stop Shop (IOSS) Overview of Changes

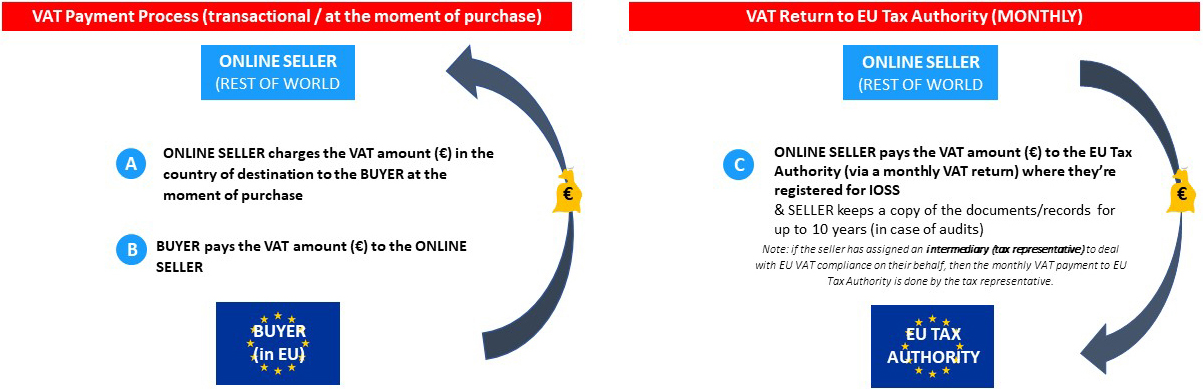

VAT Payment

One-Time IOSS Registration

- In order to use the IOSS, the online seller (non-EU but with EU representation) must register for IOSS in one European Union country. Please note there are restrictions around registration.

- Upon registration, the seller will be given one unique IOSS number which is valid for ANY country in the European Union.

- The online seller can assign an intermediary (tax representative) to deal with EU VAT compliance on their behalf, i.e. to pay the VAT amount to the EU Tax Authority (via a monthly VAT return).

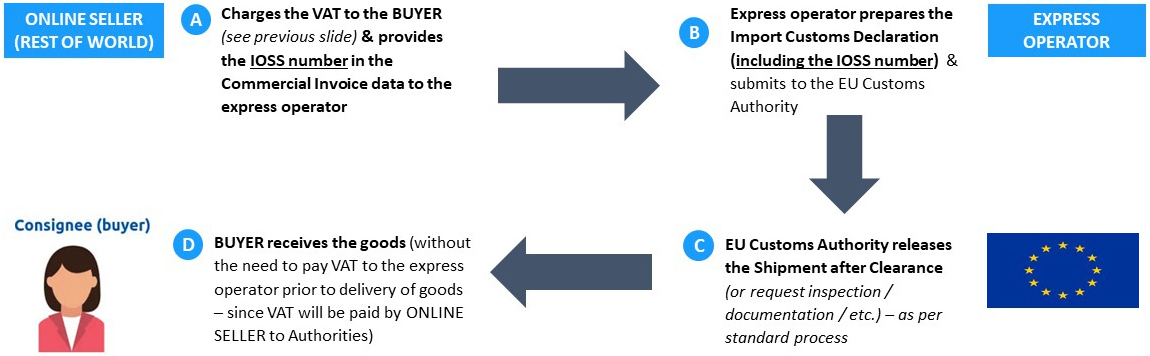

Customs Clearance

- If the VAT has already been charged (see previous slide), then the seller must indicate the IOSS number in the Commercial Invoice data to the express operator.

- The express operator will then include the IOSS number in the Import Customs Declaration submission to the EU Customs Authorities – below an overview:

Different VAT collection possibilities available for B2C shipments up to EUR 150

With IOSS (for B2C only)

- Introduces an IOSS (Import One-Stop Shop) VAT collection model with the VAT to be collected by the seller at the moment of purchase for B2C shipments.

- Companies can assign an intermediary (tax representative) to deal with EU VAT compliance on their behalf, i.e. to pay the VAT amount to the EU Tax Authority (via a monthly VAT return).

- Key Advantage: ONE Single EU VAT Registration (covering all the 27 EU countries), different than current setup, which requires 1 VAT registration for each EU country in case of DDP.

Without IOSS (for B2C or B2B)

- Either the express operator pays VAT to authorities upon import and then charges the shipper, or the shipper pays VAT directly to Authorities with its own deferment account).

Information provided by Flight Logistics Group Ltd is in the context of guidance only, the content of this presentation therefore does not, in any way, constitute legal advice. Should you require a legal opinion, you must obtain that opinion from a properly qualified professional.

Additional resources have been put in place for businesses to access more detailed Brexit guidance

The Government has launched a new package of on-demand video content to help businesses understand the new rules for doing business with Europe. You may view the full gov.uk press release here.

Businesses can get further information on 18 topics including importing and exporting, trade, data, and audit and accounting so for additional guidance register now to immediately access helpful video content.

Customs Requirements for Non-Document Shipments to and from EU Destinations

*New Customs Changes Effective March 1st 2023*

With Effect from March 1st 2023 the EU is strengthening its safety and security at customs using a large scale system called Import Control System 2 (ICS2).

As a result all “non – document” shipments, regardless of value (ie anything above zero) will need additional information for shipping by air through or into the EU, Northern Ireland, Norway and Switzerland. It’s important to note that ICS2 applies to all express material, cargo, and mail with a destination within or transit via the ICS2 mandate region, even if the final destination is not within the region. This is particularly relevant when using an Integrator service, where for example a shipment from the UK to Australasia or The Far East is very likely to travel through an EU based transit hub.

Accompanying paperwork for these shipments must include the following information:

- A minimum 8 digit Harmonised System (HS) code for every item contained in the shipment

- Full and accurate description of each item contained in the shipment

- Shipper’s EORI number

- The receiver’s EORI number

Useful information

- European HS codes are usually 8 digits for export declarations, 10 digits for imports.

- Some import codes can be 14 digits.

- First 6 digits are defined by the Harmonised System, the rest are individual.

- There can be variation in codes between countries so make sure you double check.

- Codes can provide information on whether goods are subject to controls or preference agreements.

Since January 1st 2021 all non-document shipments to and from EU countries require the same customs declarations as are required for Rest of the World non-document shipments. If you use our MyFlight system to book and produce your non-document paperwork to the Rest of the World you will be familiar with the process and our system will produce your EU shipping paperwork in exactly the same way.

The information required to ship a non-document item anywhere in the world :

- Sender and consignee address details

- Consignee contact telephone and email address (in case of duties and taxes due, Customs will contact the consignee for payment thereof) Full description of goods

- Reason for export

- Country of origin – guidance on formulating the country of origin information and creating a statement of origin if necessary can be found here

- Value for Customs (used to calculate any import duties or taxes on arrival)

- Commodity Codes (also used to calculate any applicable import duties or taxes on arrival) – click here for a useful guide to commodity codes

- A new and updated De minimis threshold list detailing current duty and tax limits globally can be found here

- Our commercial invoice template can be found here

- Our Proforma invoice template can be found here

Rules of Origin – for goods moving between the UK and EU

One of the key benefits of the EU/UK Trade Agreement is the opportunity to avoid the payment of import duties if products originate in the EU or the UK. The origin rules for some products are quite complex and differ according to their HS commodity code. Full details and guidance are available here

In summary goods from EU countries may be imported into the UK duty free if either:

- the full duty rate is zero, or

- the product meets the preferential origin rules, and may be declared as originating in the EU. (The same process will work in reverse for product of UK origin being exported to EU member states).

In order for the zero percent preferential rate of duty to apply, it is necessary to be able to declare the goods as originating in the appropriate EU member state. (Not simply being shipped from an EU member State).

When claiming preference the importer should have “proof of the originating status of the product before claiming preference. This may be a Statement of origin provided by the exporter on a commercial invoice or other commercial document that describes the goods.

It is the importer’s responsibility to possess the evidence that the origin criteria for any product has been met prior to the importation. However there are some waivers available:

- Small consignments (for the UK up to £1000). So long as they are declared to the customs authorities as meeting the origin rules, some goods may be imported without the need for a formal proof of origin (a waiver). (The EU waiver is different as it does not apply to commercial transactions)

If products do not meet the origin requirements then the full duty rate will apply. However if it is subsequently established that products do meet the origin requirements any duty paid can be reclaimed up to 3 years later.

Shipping to EFTA registered countries

There are currently no changes to the rules regarding shipping to EFTA destinations although negotiations are ongoing. To ship non-document items to Switzerland, Norway, Iceland and Liechtenstein follow our guide here

Authority for Customs Clearance

In order to avoid delays in post Brexit customs clearance for non-document items the form headed “Authority for a Customs Clearance Agent to act as Direct Representative” found here must be completed by clients – it should be printed on client letterhead, signed and authorised and returns via email to crm@flightlg.com. This authority will be held securely by us should we be required to submit it on your behalf to Customs and Excise.

For further information on authorising customs clearance and vat and deferment payments please click here

VAT & EORI

If you are importing into or exporting out of the EU you must be EORI registered. EORI (Economic Operator Registration and Identification number) is separate to VAT registration but can be linked to it. An EORI number registered with HMRC is used in the process of customs entry declarations and clearance for both imports and exports to or from the EU and outside the EU. Whilst VAT registration enables the reclaim or payment of VAT on sales and purchases – they are 2 entirely separate activities. To move goods between Great Britain and the EU your EORI must start with the GB prefix.

You do not need to be VAT registered to obtain an EORI number but the 2 often go hand-in-hand. Registration is free and straightforward and you can

apply here

For Northern Ireland

Important note: Implementation of the Windsor Framework has now been deferred by the Government until March 31st 2025. Companies should continue to prepare as the registration process is lengthy.

On 1 October 2023, the Windsor Framework came into effect providing a solution to the ‘shipping of goods between Northern Ireland and Great Britain’ debate. Changes are scheduled which will further simplify the process for both B2C and B2B. We have prepared an article to explain in detail what will be involved – HERE

If you move goods between Northern Ireland and non EU countries you will also need an additional EORI for NI – this will start with an XI prefix. For help with this click here. You cannot apply for an XI EORI without already having a GB EORI – so apply for your GB EORI first please.

International standard for wood packaging

This includes art crates and pallets. All wood packaging must have the ISPM15 stamp. You should ensure that all palletised work we collect from you is compliant, if we have to re-palletise or re-crate this is likely to delay your shipment and add in extra costs.

Customs Requirements for Overseas Postal Shipments

All “non – document” items travelling by post globally (including EU destinations) will need similar paperwork to that which is already required for international courier and freight shipments. Anyone selling goods on-line to overseas clients will be affected. For further information click here

Oversized freight shipping: hidden costs and how to avoid them

Shipping oversized or out-of-gauge freight internationally is more than just moving heavy or large items. Experienced logistics teams often Read More...

Do most brands underestimate the power of fulfilment in retaining customers?

Are you measuring fulfilment as a cost centre, or as a driver of customer lifetime value? In an era Read More...

How can logistics companies help support artists and galleries to prepare for art fairs and exhibitions in the UK

The London Art Fair has now wrapped up at Islington’s Business Design Centre. For the galleries that exhibited, success Read More...